Planned development strategy

▪ Design 4 structurally identical houses.

▪ Focus on design and approval speed - use previously tested solutions with little innovations.

▪ Very simple house structurally, but high-quality common areas, facade and apartment finishing to get «premium feel»

▪ Depend on market and financing situation we plan to build 1 house, when 40% of first house is reserved then start constrution of next house.

• We plan 4 identical middle class 10 floor buildings (2 on each land plot)

• Each building 4000 GBA m2, 3000 Net sellable m2 (+balconies ~250m2).

• Total 16 000 GBA m2, 12 000 Net sellable m2. (+balconies ~1000m2)

• Total 240 apartments and 160 on-ground parking places.

• Each building can be 1 project stage.

• Land prices 800 000 EUR and 600 000 EUR (Total 1 400 000 Eur)

• Land sizes 7579 m2 + 7579 m2 = 15 158 m2

• Land price = 92 eur/m2

• Land price per net sellable apartment m2 = 117eur/net sellable m2 based on calculation that all

cars are parked only in territory and no underground parking.

Land deals are structured with such conditions:

• Kisezera 10:

Down payment 10% (80 000EUR), 40% ( 320 000 EUR) within 4 months and land is transferred to

our spv with seller’s mortgage at 6% interest rate on remaining sum. Final payment for land must be

done within 18 months. Land seller is ready to invest 25% of required equity for all project.

• Kisezera 12:

Owned by church. Lease contract with rights to buy at fixed price after 3 years.

KEY INVESTMENT ASSUMPTIONS

1. Downpayment for land and minor expenses 85 000 EUR (10% from Kisezera 10)

2. 50 000 EUR budget to start design,

3. Parallelly sign rental with buyout option agreement for Ezermalas 12. (6% from price per year) – 36 000 for first year’s rent.

4. 320 000 EUR (40% from Kisezera 10 price)

5. 315 000 EUR for technical design and overhead.

6. 20 000 EUR to create project brand and website.

7. Negotiations with strategic partner to finance project equity. (2,5M Eur).

8. Negotiations with the bank to finance construction. (6,5M Euro)

• First stage – 2 identical buildings

• Each building 3000 Net sellable m2 (+balconies ~250m2), total 6000 net sellable m2.

• Total income from apartments and parkings 12 400 000 Eur (after full VAT paid)

Real estate development project

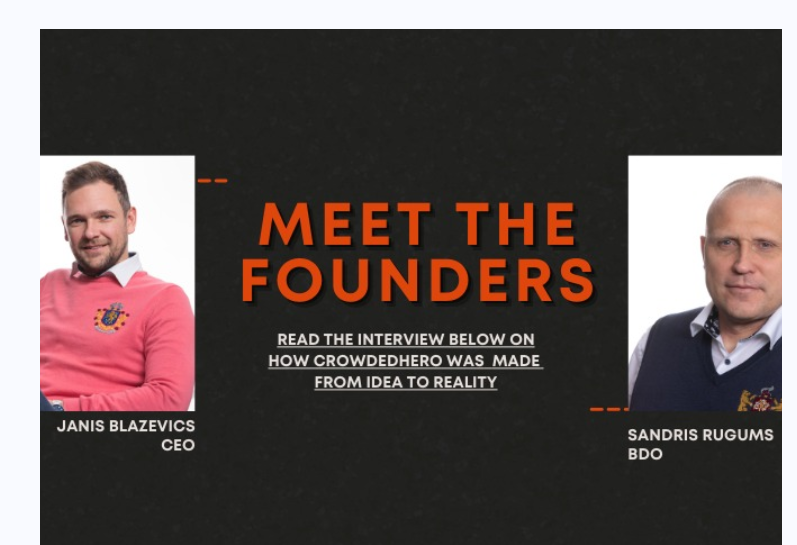

Experienced technical director